From the perspective of the semiconductor industry, the report shows that the United States occupies a dominant position in this field, accounting for 37.4% of the total number of semiconductor enterprises. The total R&D investment is even greater, reaching 62.6% (50.824 billion euros) of the total R&D investment of all semiconductor enterprises, which is 84.1 billion euros. Although the number of semiconductor enterprises on the list in Chinese Mainland accounted for 14.4% of the total number of semiconductor enterprises on the list, the total R&D investment was only 2.862 billion euros, accounting for only 3.5% of the total R&D investment of all semiconductor enterprises on the list.

On December 14th, the European Commission (also known as the European Commission Executive Committee) released the latest "The 2023 EU Industrial R&D Investment Scoreboard" (2023 EU Industrial R&D Investment Ranking), which compiled statistics on the top 2500 companies in global R&D investment, with Huawei in China ranking fifth.

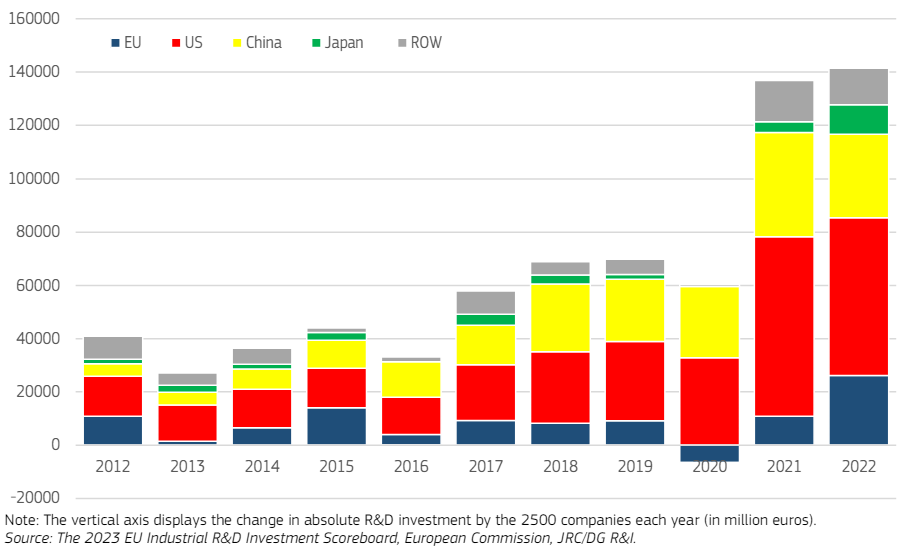

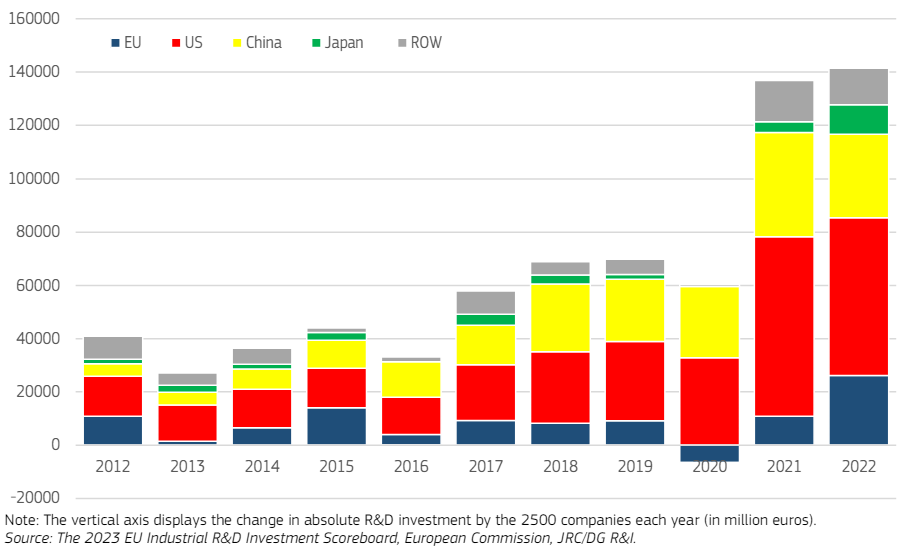

The report shows that the total R&D amount in 2022 increased by 12.8% year-on-year, reaching a record breaking 1249.9 billion euros. In the published list of Top 50 enterprises, Huawei China ranks fifth.

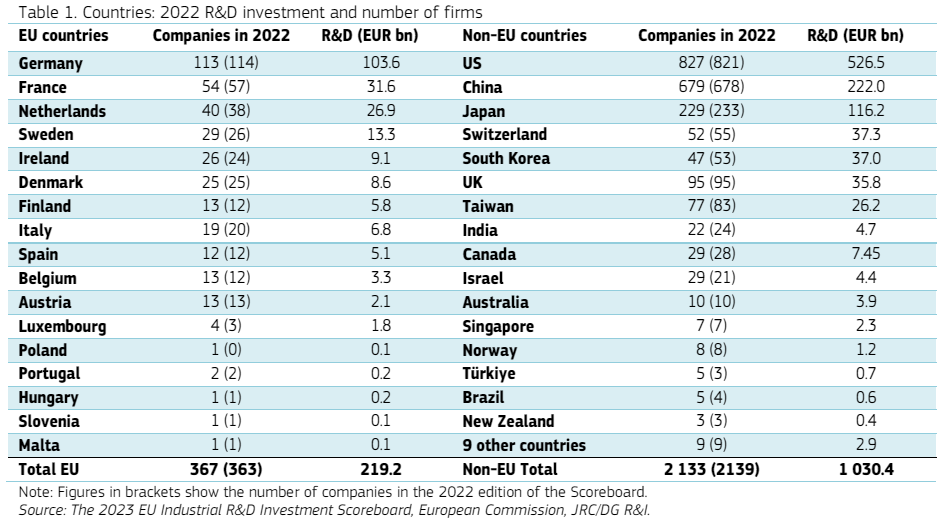

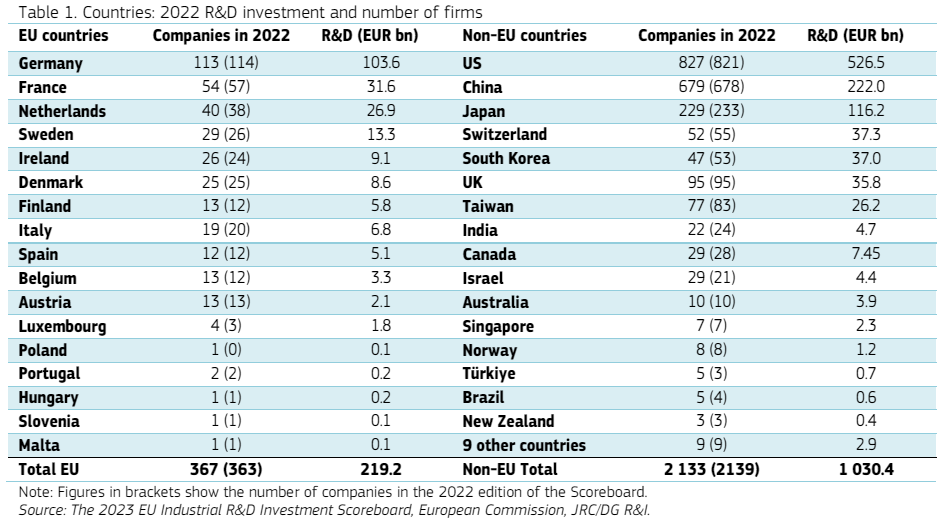

Country/region ranking: 679 in Chinese Mainland, ranking second

Among these 2500 companies, 827 in the United States entered the list, ranking first, with 6 more companies than in 2021, and a total R&D investment of 526.5 billion euros;

679 companies from Chinese Mainland entered the list, ranking second, one more than 2021, with a total R&D investment of 222 billion euros;

Japan has 229 companies on the list, ranking third, but 4 fewer than in 2021, with a total R&D investment of 116.2 billion euros;

113 companies from the European Union have entered the list, ranking fourth (with Germany ranking first with 113 companies on the list);

Switzerland has 52 companies on the list, ranking fifth, a decrease of 3 compared to 2021;

47 companies from South Korea entered the list, ranking sixth, but a decrease of 6 compared to 2021; 95 companies in the UK have entered the list, which is on par with 2021 and ranks seventh;

There are 77 companies in Taiwan, China, ranking eighth, down 6 from 2021;

22 companies from India have entered the list, ranking ninth, a decrease of 2 compared to 2021;

Canada has 29 companies on the list, ranking tenth, an increase of one compared to 2021.

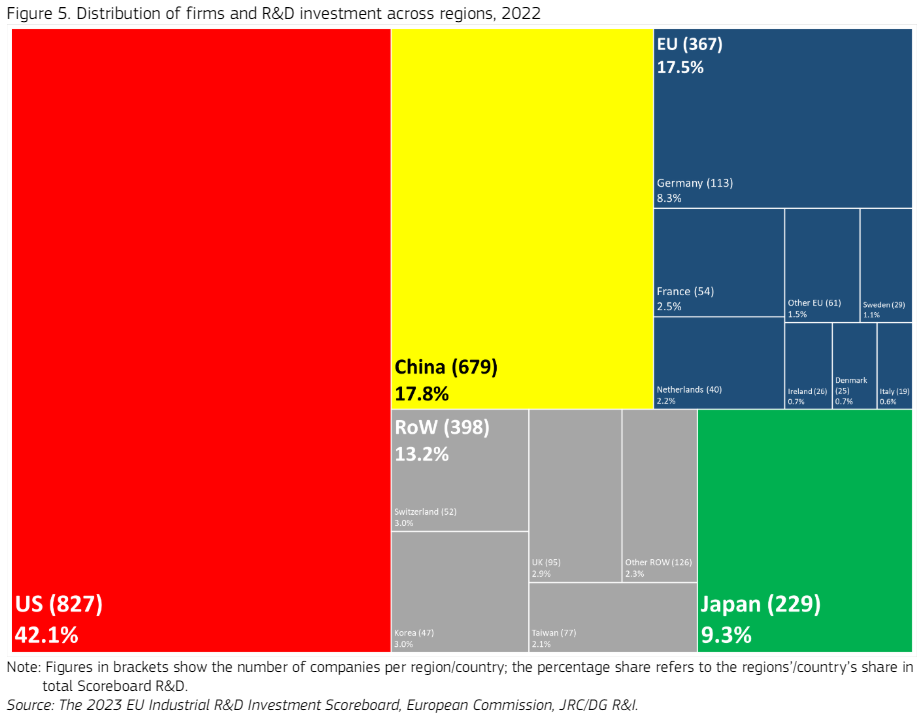

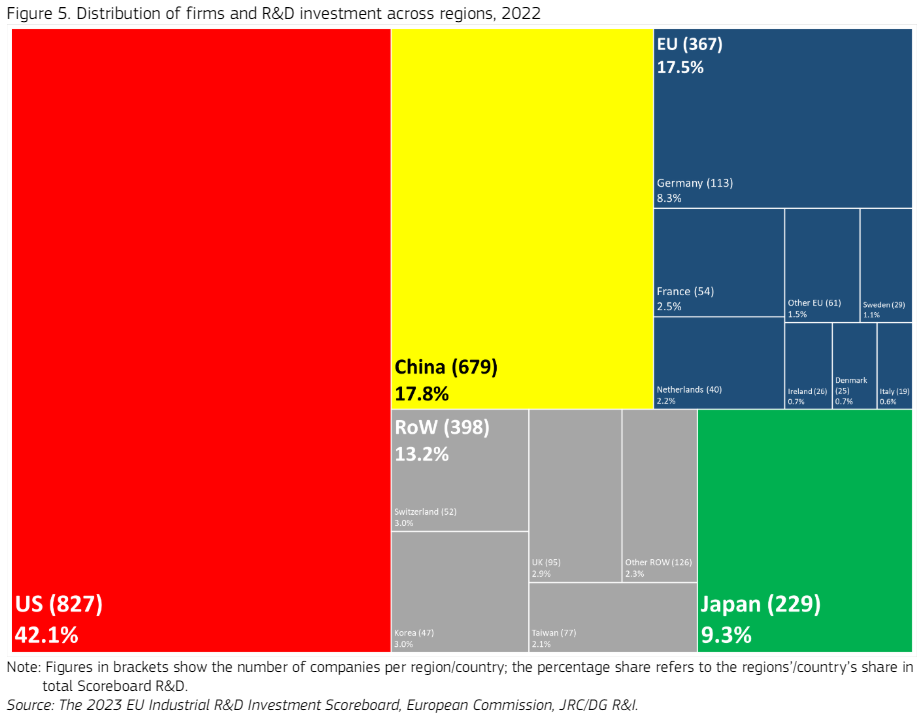

Regional R&D ranking

From the perspective of the proportion of R&D investment in various regions, the United States accounted for as much as 42.1% of the total R&D investment with 33.08% of listed companies, China's R&D investment accounted for 17.8%, the EU's R&D investment accounted for 17.5% (with Germany accounting for 8.3%), and Japan's R&D investment accounted for 9.3%.

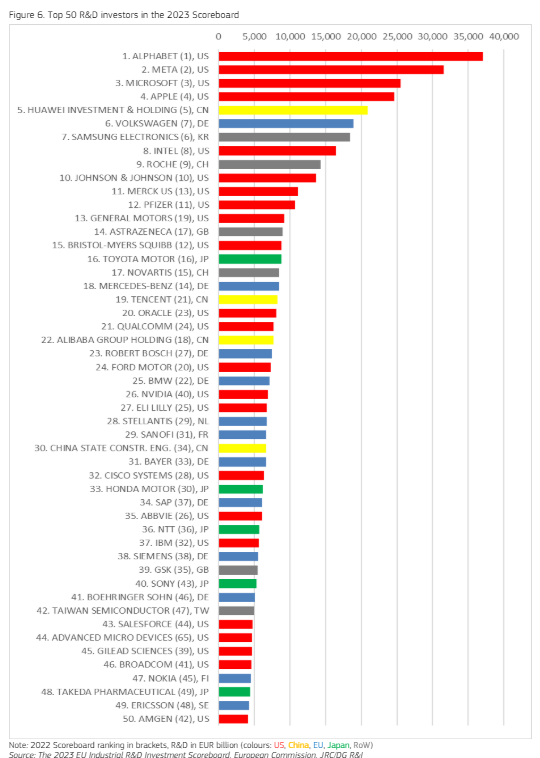

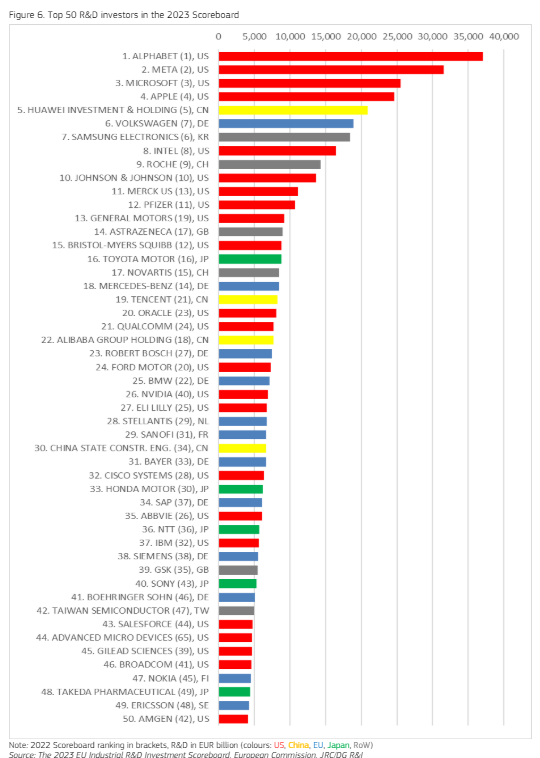

According to the ranking of R&D investment amount among the top 50 companies, the company with the highest R&D investment amount globally in 2022 is Google's parent company Alphabet, which reached 37.034 billion euros;

Meta ranks second with 31.52 billion euros; Microsoft ranked third with 25.497 billion euros; Apple ranks fourth with 24.612 billion euros;

Huawei, a company in Chinese Mainland, ranked fifth with an R&D investment of 20.925 billion euros;

Volkswagen ranks sixth with a research and development investment of 18.908 billion euros; The seventh place is Samsung Electronics from South Korea, the eighth place is Intel, the ninth place is ROCHE, and the tenth place is Johnson&Johnson.

The report shows that the top 50 companies have all significantly increased their R&D investment in 2022, with Meta (a year-on-year increase of 36%), Nvidia (39%), AMD (76%), and TSMC (ranked 42nd, a year-on-year increase of 30.9% to 4.985 billion euros) showing the most significant changes.

ICT industry ranking

From the perspective of ICT companies that produce computer hardware, electronic and electrical equipment, semiconductors, and telecommunications equipment, the top ten manufacturers in the ICT industry with R&D investment in 2022 are:

Apple (24.612 billion euros, a year-on-year increase of 20%)

Huawei (20.925 billion euros, a year-on-year increase of 11%)

Samsung Electronics (18.435 billion euros, a year-on-year increase of 10%)

Intel (16.434 billion euros, a year-on-year increase of 15%)

Qualcomm (7.682 billion euros, a year-on-year increase of 14%)

Nvidia (6.882 billion euros, a year-on-year increase of 39%)

TSMC (4.985 billion euros, a year-on-year increase of 31%)

AMD (4.692 billion euros, a year-on-year increase of 76%)

ASML (3.072 billion euros, a year-on-year increase of 26%)

Ningde Times (3.072 billion euros, a year-on-year surge of 110%).

The ICT industry is the industry with the largest R&D investment, with a total R&D investment of 285.6 billion euros (adjusted for inflation to 243.1 billion euros).

However, the number of ICT manufacturers in the report decreased from 591 (23.6%) in 2012 to 470 (18.8%) in 2022. Although the number of enterprises has decreased, the overall R&D investment has remained relatively stable, only slightly decreasing from 24.2% in 2012 to 22.9% in 2022.

Overall, since 2012, the average annual growth rate of R&D investment in the ICT industry has been 6.1% (adjusted for inflation at 4.8%).

Among them, the computer hardware industry has the strongest growth with an average compound annual growth rate of 8.7%, followed by the semiconductor industry with an average compound annual growth rate of 7.1%, the electronic and electrical equipment industry with an average compound annual growth rate of 6.4%, and the telecommunications equipment industry with an average compound annual growth rate of 5.3%.

Ranking of R&D investment by semiconductor companies

From the perspective of the semiconductor industry, the report shows that the United States occupies a dominant position in this field, accounting for 37.4% of the total number of semiconductor enterprises. The total R&D investment is even greater, reaching 62.6% (50.824 billion euros) of the total R&D investment of all semiconductor enterprises, which is 84.1 billion euros.

Although the number of semiconductor enterprises on the list in Chinese Mainland accounted for 14.4% of the total number of semiconductor enterprises on the list, the total R&D investment was only 2.862 billion euros, accounting for only 3.5% of the total R&D investment of all semiconductor enterprises on the list.

The manufacturer with the largest investment is Intel, ranked 8th, with a research and development investment of up to 16.4 billion euros;

Nvidia ranks 26th with a research and development investment of 6.9 billion euros;

AMD ranks 44th with a research and development investment of 4.7 billion euros;

TSMC ranks 42nd with a research and development investment of 4.985 billion euros;

SK Hynix ranks 54th with a research and development investment of 3.3 billion euros;

ASML ranks 64th with a research and development investment of 3.1 billion euros;

NXP Semiconductor ranks 111th with a research and development investment of 2 billion euros;

Infineon ranks 113th with a research and development investment of 1.9 billion euros.

English

English